CFD Trading Innovations: Exploring New Frontiers

In the ever-evolving world of financial markets, Contract for Difference CFD trading has emerged as a dynamic and versatile instrument. It offers traders the ability to speculate on the price movements of various assets without owning the underlying asset itself. As technology continues to advance, CFD trading has seen significant innovations that are transforming the landscape and opening up new frontiers for traders. In this article, we’ll delve into some of the latest CFD trading innovations and how they are reshaping the industry.

What is CFD Trading?

Before we explore the innovations, let’s briefly recap what CFD trading is. A Contract for Difference (CFD) is a financial derivative that allows traders to speculate on the price movements of an underlying asset, such as stocks, commodities, indices, or cryptocurrencies, without actually owning the asset. The trader enters into a contract with a broker, agreeing to exchange the difference in the asset’s price from the time the contract is opened to when it is closed.

The Rise of Algorithmic Trading

One of the most significant innovations in CFD trading is the rise of algorithmic trading. Algorithmic trading, also known as algo-trading, involves using computer algorithms to execute trades at high speeds and with minimal human intervention. These algorithms are designed to analyze market data, identify trading opportunities, and execute orders based on predefined criteria.

Algorithmic trading offers several advantages to CFD traders:

Speed and Efficiency: Algorithms can process vast amounts of data and execute trades in milliseconds, ensuring that traders can capitalize on even the smallest price movements.

Reduced Emotional Bias: By removing human emotions from the trading process, algorithmic trading helps to eliminate impulsive and irrational decisions, leading to more consistent and disciplined trading strategies.

Backtesting and Optimization: Traders can backtest their algorithms using historical data to evaluate their performance and make necessary adjustments before deploying them in live markets.

Artificial Intelligence and Machine Learning

Another groundbreaking innovation in CFD trading is the integration of artificial intelligence (AI) and machine learning (ML) technologies. AI and ML have the potential to revolutionize trading by analyzing vast datasets, identifying patterns, and making predictions with a high degree of accuracy.

AI-powered trading systems can continuously learn and adapt to changing market conditions, enabling traders to stay ahead of the curve. These systems can analyze news sentiment, social media trends, and other relevant data points to generate trading signals and optimize trading strategies.

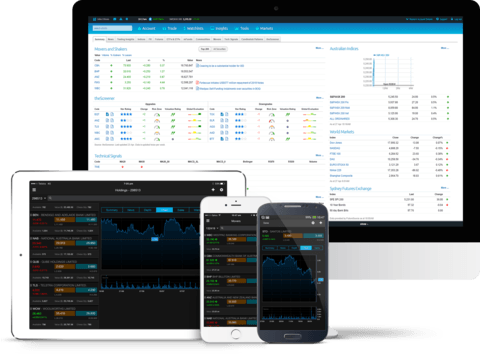

Enhanced Trading Platforms and Tools

The evolution of trading platforms and tools has also played a crucial role in advancing CFD trading. Modern trading platforms offer a wide range of features and functionalities designed to enhance the trading experience and provide traders with a competitive edge.

Some key innovations in trading platforms include:

Advanced Charting and Technical Analysis Tools: Traders can access a plethora of charting tools, technical indicators, and drawing tools to conduct in-depth technical analysis and make informed trading decisions.

Real-Time Market Data and News Feeds: Trading platforms provide real-time market data, news feeds, and economic calendars, enabling traders to stay updated with the latest market developments and events.

Customizable Dashboards and Workspaces: Traders can personalize their trading environments by customizing dashboards and workspaces to suit their preferences and trading styles.

Mobile Trading and Accessibility

The proliferation of smartphones and mobile devices has made CFD trading more accessible than ever before. Mobile trading apps allow traders to monitor their positions, execute trades, and manage their accounts on the go. This level of accessibility ensures that traders can stay connected to the markets and seize trading opportunities anytime, anywhere.

Risk Management and Automation

Effective risk management is paramount in CFD trading, and recent innovations have introduced advanced risk management tools and automation features to help traders protect their capital and minimize losses.

Some notable risk management innovations include:

Automated Stop-Loss and Take-Profit Orders: Traders can set automated stop-loss and take-profit orders to ensure that their positions are closed at predefined price levels, reducing the risk of significant losses.

Risk Assessment and Position Sizing Tools: Trading platforms offer risk assessment and position sizing tools that help traders determine the appropriate position size based on their risk tolerance and account balance.

Conclusion

As technology continues to advance, CFD trading is experiencing a wave of innovations that are transforming the way traders approach the markets. From algorithmic trading and AI-powered systems to enhanced trading platforms and mobile accessibility, these innovations are opening up new frontiers and providing traders with unprecedented opportunities. By staying informed and embracing these advancements, traders can navigate the complexities of CFD trading with confidence and achieve their financial goals.