Algorithmic Trading in the CFD Market

In recent years, algorithmic trading has revolutionized the financial industry. This technology-driven approach is making waves, especially in the Contracts for Difference (CFD) market. If you’re intrigued by how algorithms can transform your trading strategy, you’re in the right place. This blog aims to demystify algorithmic trading and show why it’s a game-changer for CFD trading.

What is Algorithmic Trading?

Algorithmic trading involves using computer programs to execute trades based on predefined criteria. These algorithms can analyze market conditions, identify trading opportunities, and execute trades at optimal times. The main advantage? Speed and efficiency that human traders can’t match.

The Rise of Algorithmic Trading

Algorithmic trading isn’t new, but its application in the CFD market is gaining traction. With advances in technology and data availability, more traders are adopting this approach. It’s not just for institutional traders anymore; even retail traders can benefit from algorithms.

Why Use Algorithmic Trading in CFDs?

CFDs are complex financial instruments that require precise timing and execution. Algorithmic trading can handle these complexities effortlessly. By automating the trading process, algorithms minimize human error and emotional decision-making.

Key Components of an Algorithmic Trading System

To understand how algorithmic trading works, it’s essential to know its core components:

• Data Feed: Provides real-time market data.

• Trading Algorithms: Set of rules for making trading decisions.

• Execution System: Executes trades automatically based on the algorithm.

Developing Your Trading Algorithm

Creating a trading algorithm involves several steps:

1. Define Your Strategy: Identify the market conditions and trading signals you want to target.

2. Backtesting: Test your algorithm using historical data to gauge its effectiveness.

3. Optimization: Refine your algorithm to improve performance.

Types of Trading Strategies

There are various strategies you can implement in algorithmic trading:

• Trend Following: Identifying and trading in the direction of market trends.

• Mean Reversion: Betting that asset prices will revert to their mean.

• Arbitrage: Exploiting price discrepancies between different markets.

Advantages of Algorithmic Trading

Algorithmic trading offers numerous benefits:

• Speed: Algorithms can execute trades in milliseconds.

• Accuracy: Eliminates human error.

• Scalability: Can manage multiple trades simultaneously.

Risks and Challenges

While algorithmic trading has its advantages, it’s not without risks:

• Technical Failures: System glitches can lead to significant losses.

• Overfitting: An overly complex algorithm may perform well in backtests but fail in real markets.

• Market Impact: High-frequency trading can sometimes distort market prices.

Regulatory Considerations

It’s crucial to be aware of the regulatory landscape when engaging in algorithmic trading. Different countries have varying rules, and non-compliance can result in hefty fines.

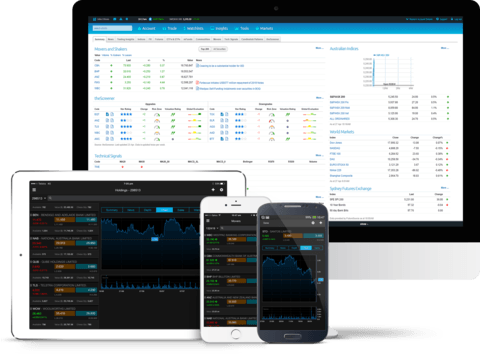

Tools and Platforms

Numerous tools and platforms can help you get started with algorithmic trading:

• MetaTrader 4/5: Popular among retail traders.

• NinjaTrader: Offers advanced charting and backtesting features.

• Python Libraries: Such as Pandas and NumPy for custom algorithm development.

The Future of Algorithmic Trading

The future looks promising for algorithmic trading in the CFD market. Advances in artificial intelligence and machine learning are likely to make algorithms even more efficient and effective.

Getting Started

If you’re new to algorithmic trading, start small. Use demo accounts to test your algorithms without risking real money. Gradually, as you gain confidence, you can scale up your operations.

Conclusion

Algorithmic trading is transforming the CFD market by offering speed, efficiency, and accuracy. While it comes with challenges, the benefits far outweigh the risks for those willing to invest the time and effort. Ready to take your CFD trading to the next level? Explore algorithmic trading today!